Reselling Luxury: an Oxymoron or an Opportunity?

- 20th May 2020

- 2811

- 0

Can brands thrive in the secondhand luxury market? In one word, yes. In this article, we’ll explore the drivers behind the flourishing resale luxury market.

“Second-hand” or “used” or “refurbished” are terms often perceived skeptically. It’s accompanied by the scrunching of noses or the classic raised eyebrows that say, “Are you sure you can’t go for the original?” When it comes to luxury, this kind of reception is off-putting and discouraging. However, in this new age where Millennials and Gen Z dominate the marketplace, where digital natives reign and where environment protection and sustainability are growing concerns… Luxury secondary market is presenting an opportunity to engage, immerse and involve with the modern customers.

What does it exactly mean though? Secondary market offers a space for sale and purchase of premium original and designer items. The sellers on secondary market entrust their possessions to retail (and online) consignment stores and the buyers are awarded with the freedom to obtain luxury at discounted prices.

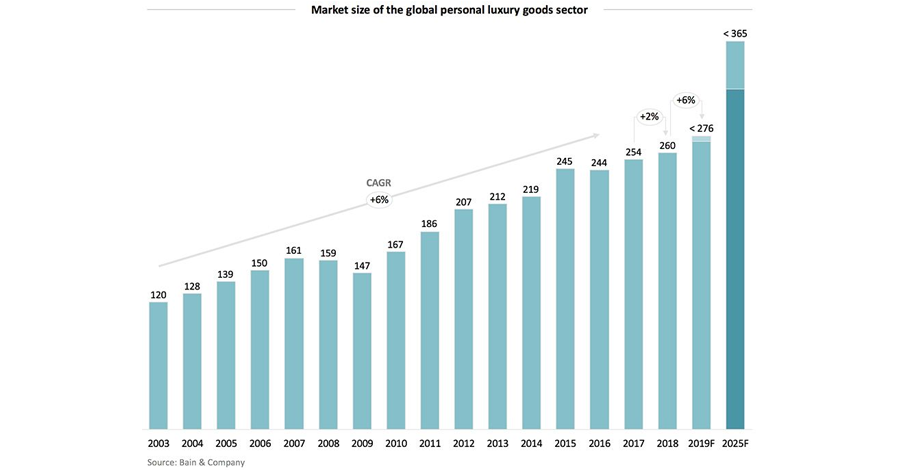

Source : https://www.consultancy.eu/news/2901/spending-on-personal-luxury-goods-to-top-270-billion-this-year

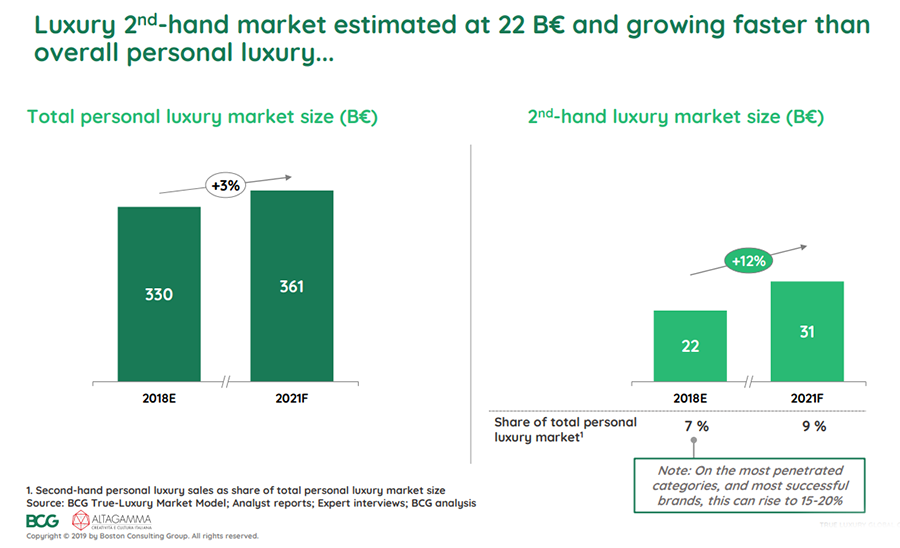

The personal luxury goods market has expanded over the years and in 2019, its value was 281 billion euros worldwide. Simultaneously, the secondary market has always existed but a negative stigma has been attached to it. Now, however, the secondary luxury market is about to step out of the shadow and is predicted to grow from an estimated $25 billion in revenues in 2018 to around $36 billion in 2021, according to the 2019 BCG-Altagamma True-Luxury Global Consumer Insight study. The current Corona pandemic may have an effect on it, though.

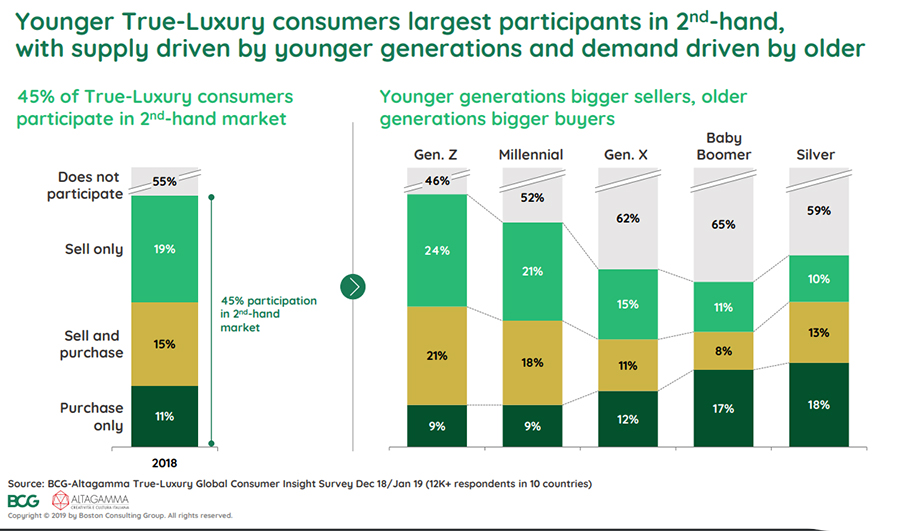

The largest participants of secondhand market are millennials (48%) and members of Generation Z (54%). The vintage market has enraptured the attention of the much coveted younger generations - the values it stands for and the amenity it provides, resonates deeply with them.

Source : 2019 True - Luxury Global Consumer Insight

Let us take a look at the factors that are motivating the growth of the secondary luxury market.

Affordability

34% of True-Luxury consumers —consumers that averaged $44,000 in total luxury spending— sell secondhand products, while 26% buy pre-owned goods. (BCG x Altagamma)

Luxury resale offers numerous touch-points for customers looking at value-for-money and good deals. It widens the audience for the brand by providing encouragement for purchase. The survey conducted by BCG also put forward the finding about respondents’ perception - they purchase more luxury items because of the resale market rather than buying directly from the primary markets.

As millennials and Gen Z increasingly captures the market for luxury, it is necessary to realise their spending capacity. 71% of the preowned item buyers lean toward items and brands that they can’t afford firsthand. As first time buyers, second hand luxury items provide them with an impetus to invest in luxury.

Brands are also provided with the opportunity to bond with buyers who would, in future, develop into primary customers. The brand anchors itself in their minds converting them into loyalists. As the consumers’ purchasing power increases, they would invest increasingly in this particular brand that they are acclimatised with and prefer, thus creating a powerful recruiting mechanism.

Secondhand sellers are firsthand buyers. They resale belongings to attain back a portion of the money they spent on their firsthand purchases. This regained money is further reinvested in novel extravagance benefitting the primary market luxury brands. As reselling becomes easier, primary luxury customers even tailor their purchases according to the anticipated resale value, boosting their purchasing power.

Digitalisation and Accessibility

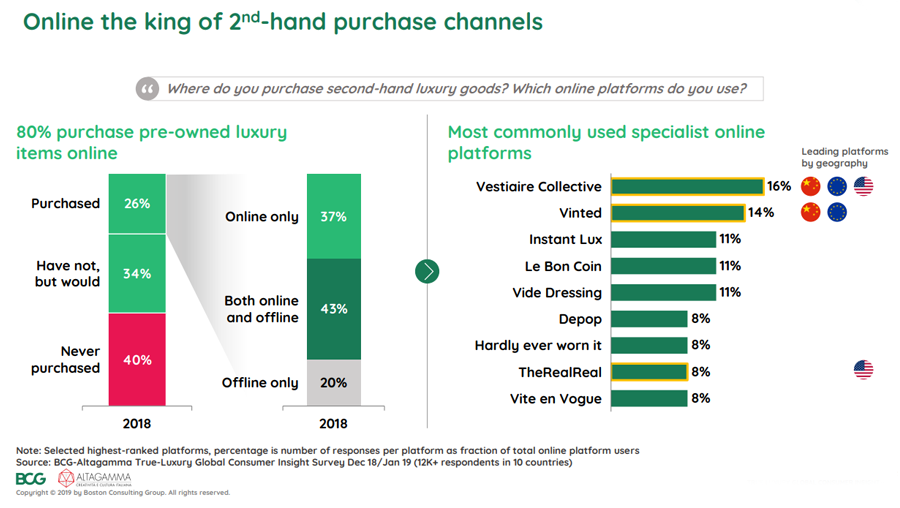

80% of secondhand market participants use online channels to get informed and to trade. (BCG x Altagamma)

Source : Source : 2019 True - Luxury Global Consumer Insight

Digital and online platforms are accelerating secondhand purchases and reselling by providing easy accessibility to everyone! It is booming with the emergence and increasing popularity of many different digital platforms - Vestiaire Collective, The RealReal, Fashionphile etc. Digitalisation also presents a way for the primary marketeers to obtain unique data insights pertaining to purchasing patterns, underlying trends, consumer behaviour and preferences and feedback about the products and positioning.

Traditionally, the global luxury market has been scattered into individual boutiques and brands that relied upon personal transactions. Contemporary digital platforms provide a consolidated space that offers an exclusive assortment of all types and styles of luxury products; a seamless end-to-end experience. Access to a broad range of products drives growth of the online stores more than conventional brick-and-mortar.

These platforms have also developed mechanisms to verify the authenticity and quality of the secondhand luxury items resold on their platform. The premium consumer experience and satisfaction, coupled with the comfort of digital transactions is a gratifying way for the digital-savvy to indulge in extravagance.

However, digitalisation sometimes falls on its face as the credibility of second hand luxury online stores is tossed out of the window. Chanel filed lawsuits against The RealReal for trademark infringement and counterfeiting claims. Chanel alleged that an investigation it performed revealed TRR had sold “at least seven counterfeit Chanel handbags” that had been held out as genuine and authentic.

Sustainability

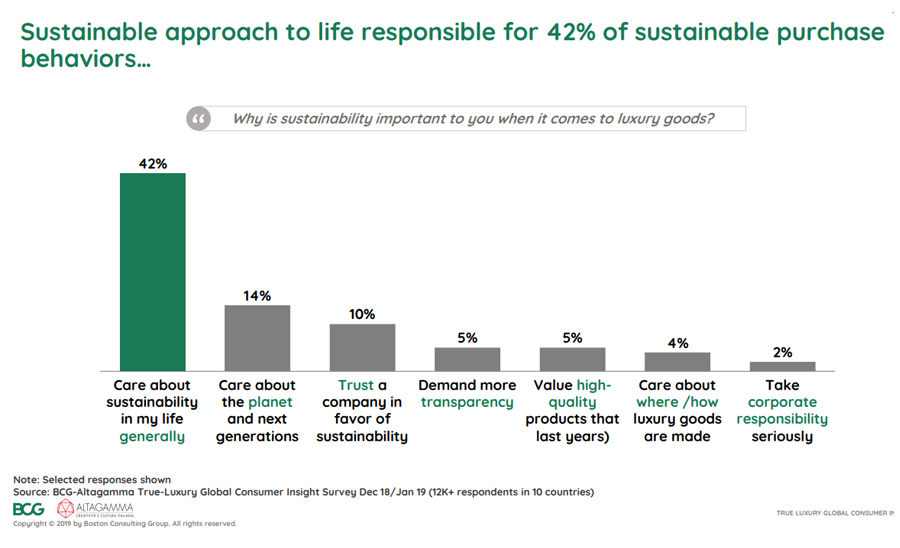

More than 70% of respondents say that they try to shop ethically and 13% say that sustainability is extremely important to them. Of those that shop ethically, 57% say that environmental impact is their primary concern. (BCG x Verstiaire Collective)

Source : Source : 2019 True - Luxury Global Consumer Insight

The modern affluent consumers today are driven by purpose. They are affected by the environmental impact fast fashion creates and are looking for ways to develop sustainability through their purchases. According to BCG, most products sold on preowned luxury platforms are of high quality, with 62% of them unworn or scarcely worn (worn three to ten times). The preowned market extends the lifetime of luxury products. For millennials, social and ecological aspects matter; they tend to look for responsible ways to consume.

Kering, the group which owns luxury brands like Gucci and Yves Saint Laurent, works actively with The RealReal to move unsold goods, which would otherwise, be destroyed. In 2018, Burberry faced severe backlash on social media when the millennial customer discovered that the brand had torched more than $37 million worth of unsold goods.

As the urge to protect the environment grows, so does the need for brands to look beyond one-sale models and to earnestly adopt the circular luxury economy design. This path is not only a positive approach from an ecological point of view, but it also strongly complements CSR initiatives increasing the sustainability credentials of the brand.

Stella McCartney was the first luxury brand to promote sustainable luxury by partnering with The RealReal. The “make well, buy well, resell” model cheered people on to extend the life of Stella McCartney products through resale. Anyone who consigned Stella McCartney pieces on the resale platform received a $100 store credit to shop at any of the brand’s retail stores or via its website.

Source : https://promotion.therealreal.com/stellamccartney/

Rebag is an online platform for the purchase and reselling of handbags exclusively. Infinity Exchange is an initiative of the platform for sustainable development possessing the characteristics of fast fashion. It allows the consumer to enjoy their “new” handbag for a period of 3-12 months and exchange it for credit worth 70-80% of its price which can be applied towards a new bag/accessory.

Durability and Collectability

62% of respondents find preowned market attractive today because they’re looking for sold out items/limited editions. (BCG x Verstiaire Collective)

Source : Source : 2019 True - Luxury Global Consumer Insight

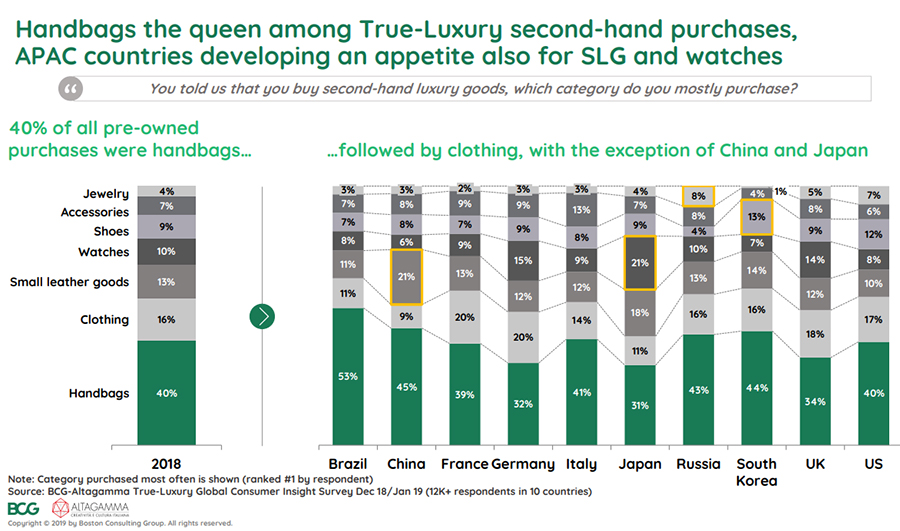

The overall build and quality of luxury items is exceptional, making them very durable. Second hand luxury bags are some of the most popular choices for resale and the demand is a testament to their condition. This timeless nature of luxury items carves a niche for itself in the resale market.

Source : 2019 True - Luxury Global Consumer Insight

Rare and iconic items that are scarce in the firsthand sales network make an attractive case for preowned resale. It has the potential to unearth breathtaking limited editions, previous-seasons’ collections and vintage exclusives. It presents a chance to collect these precious elements for those who missed out on them at the primary market. Resale premium built into the item may sometimes lead to an inflation in the price making it more expensive than what it cost at the firsthand market.

Source : 2019 True - Luxury Global Consumer Insight

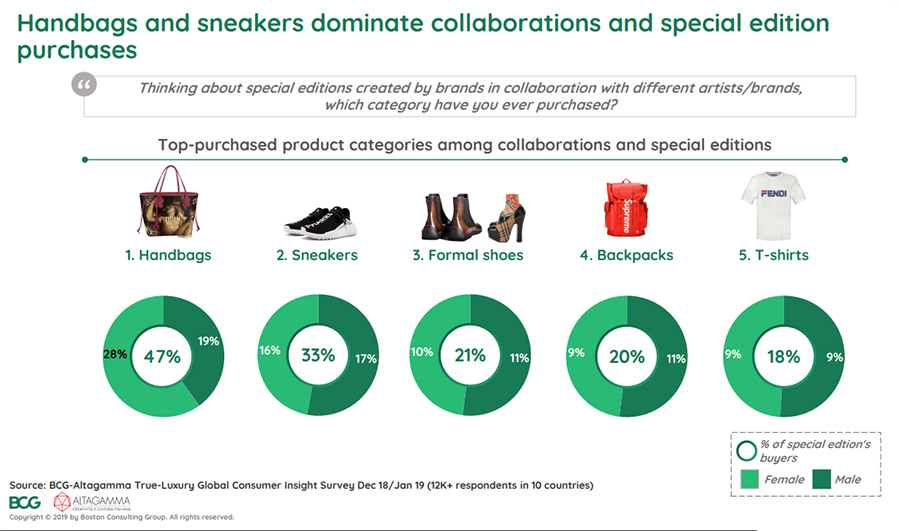

Collaborations with artists and other brands are a special touch to the usual luxury items. These collaborated collectibles are enticing, especially for the younger generations. According to GCB, “awareness of such collaborations reached around 90% of survey participants in 2018, and 50% of them had actually purchased collaborations or special editions. Such purchases are most common among Chinese customers (62% of those surveyed) and younger generations of shoppers (67% of Generation Z customers and 60% of millennial customers).”

Some other initiatives by brands

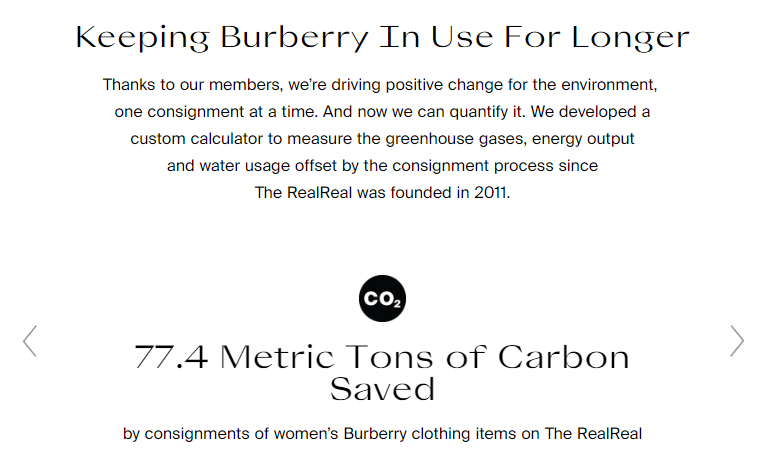

Source : https://promotion.therealreal.com/burberry/

Extending the life of clothes by just nine extra months of active use would reduce carbon, waste, and waste footprints by around 20–30% each. (WRAP)

Experiential rewards: Burberry x The RealReal

Source : https://sourcingjournal.com/topics/sustainability/burberry-the-realreal-resale-personalized-shopping-consignment-173161/

The sustainability program launched by Burberry encouraged customers to consign the brand’s pieces in exchange for an exclusive “personal styling appointment and British High Tea” in select Burberry stores across the U.S.

Building/Acquiring/investing in resale sites: Arc’teryx x Rock Solid

Arc’teryx, a high performance outdoor equipment company, launched its own resale site. The brand buys back its pieces from the consumers, refurbishes them and then sells them at discounted prices.

The merging of the offline and the online: Vestiaire Collective x Selfridges

Source : https://footwearnews.com/2019/business/retail/selfridges-vestiaire-collective-resale-market-1202864908/

Verstiare opened its brick and mortar boutique at Selfridges on Oxford Street. Consumers were able to sell their “pre-loved” items through the physical incarnation of Vestiaire’s Concierge Service at a designated sale point in the store.

The Culmination - Get on the Brandwagon

The secondhand luxury market is expected to increase by an average of 12% per annum, boosting its share of total personal luxury goods to around 9%. (BCG x Altagamma)

In these times of Covid-19 pandemic, although the traditional luxury sales are predicted to diminish, the secondhand luxury market is DEFINITELY thriving, flourishing and booming. Many brands haven’t yet realised the potential of the secondary luxury market but some others are fast catching on and are increasingly investing in it. Secondhand sales (dubbed vintage collectibles) are a win-win situation.

Rajeshwari Patwardhan

Rajeshwari Patwardhan

Comments

No comments yet.

Add Your Comment

Thank you, for commenting !!

Your comment is under moderation...

Keep reading luxury post